This is a hands-on, technical guide for brand owners, wholesalers, and e-commerce retailers. It explains how slippers are built, what to test, how to write a spec, how to calculate costs, how to plan timelines, and how to verify a factory the right way.

1) Know What You’re Buying: Product Types & Build Methods

Common constructions

- Textile indoor slippers (stitched/cemented): upper (terry/coral fleece/knit/woven) + sponge/foam + insole board + EVA/TPR or fabric outsole.

- EVA/PE slides (injection/foam compression): one-piece injected or molded components glued together.

- PU molded slippers: molded footbed + strap (often PU + foam), costlier; watch for hydrolysis in humid climates.

- Cork/rubber hybrids: cork footbed (FSC sources) with EVA or rubber outsole.

When to choose which

- Indoor/cozy lines: textile builds; low tooling; flexible MOQs.

- Pool/beach/value retail: EVA slides; tooling cost but very scalable.

- Premium feel: PU molded or cork hybrids; higher unit cost; stronger brand positioning.

2) Materials That Matter (with realistic spec ranges)

Foams & soles

- EVA / rEVA: density 0.15–0.25 g/cm³; hardness Shore C 45–60. rEVA can include ≥20% recycled content (request declaration + test).

- TPR outsoles: durable, flexible; hardness Shore A 55–70; better cold-flex than EVA.

- Rubber: grippier, heavier; higher cost; great for slip resistance.

- Cork: light, moisture-resistant; pair with EVA/rubber bottom; ask for FSC sourcing.

Textiles (upper/lining/insole cover)

- Terry/coral fleece: 220–300 g/m² typical; warm and forgiving on fit.

- Woven/knit polyester or rPET: pick 100D/150D yarn specs for rPET; ask for GRS chain-of-custody.

- Bamboo viscose blends: soft/absorbent; verify pilling and dimensional stability.

- Organic cotton: GOTS supplier scope; 160–220 g/m² for uppers/linings.

- Wool felt blends: premium winter lines; specify blend ratio (e.g., 30% wool).

Adhesives & threads

- Water-based adhesives preferred (lower VOC).

- Thread: poly 40/2 or 20/2 commonly used; match needle size to fabric to reduce seam slippage.

Color & finish

- Use Pantone TCX (textiles) or Pantone C/U (prints) with tolerance ΔE ≤ 1.0–1.5 for hero colors.

- Add anti-yellowing requirements for white EVA.

3) The Test Plan (don’t skip this)

Performance & safety (select by product)

- Slip resistance: EN ISO 13287 (dry/wet tile); define minimum COF threshold.

- Color fastness: ISO 105-X12 (rubbing), ISO 105-E04 (perspiration), ISO 105-E01 (water).

- Abrasion: Martindale on fabric upper/lining; set cycles (e.g., 10k–20k) by price tier.

- Flexing: upper seam/fold; for EVA slides check flex crack observation after 30k–50k cycles.

- Odor/chemicals: If selling into EU/US or via UAE re-export, add REACH SVHC screening and Prop 65 awareness.

- Dimensional checks: length/width tolerance ±2–3 mm; strap position ±1 mm; pair matching within ±3 mm.

Documentation

- Pre-define Critical/Major/Minor defects list (e.g., outsole detachment = critical).

- Require lab test reports for eco claims: GRS TC (transaction certificates), GOTS scope, FSC for packaging.

4) Writing a Rock-Solid Tech Pack (Template)

Include:

- Style ID & season, target retail, target markets.

- Size spec (EU/US/UK with tolerances), last/footbed measurements, size run plan.

- Materials table (upper/lining/insole/outsole/foam/adhesive) with GSM, hardness, density, color codes.

- Construction drawings (stitch type, seam allowance, bonding areas).

- Branding (logo technique: embroidery, heat-transfer, print; Pantone codes).

- Packaging (polybag/no-plastic, FSC box spec, barcode standard GS1, inner pack, master carton spec & ECT/Burst).

- Test plan (from section 3) & AQL (see section 7).

- Labeling (fiber content, care, origin; Arabic/English when needed).

- Change control (no substitution without buyer’s written approval).

5) MOQ & Cost Levers (and how to push them)

How factories think about MOQ

- Material MOQs (fabric dye lots, outsole colors), changeover time, yield loss.

- For textile slippers, 500 pairs/style is achievable with smart color/material choices.

- For complex 3D/PU molded/EVA injected, expect 1,000+ pairs (tooling amortization).

Levers you control

- Consolidate materials/colors across styles → higher material hit rate.

- Accept standard linings/footbeds on first PO → lower setup cost.

- Batch orders quarterly to hit price breaks.

- Packaging standardization (one box size, neutral print) → carton efficiency.

6) BOM Costing & Landed Cost (with formulas)

BOM (ex-factory)

- Materials (textiles/foam/outsole/labels/packaging)

- Labor & overhead

- Wastage (2–5% typical textiles; more on complex uppers)

- Tooling (if EVA/PU; amortize per pair over forecast volume)

Freight & customs (high level)

- FOB price + Ocean/Air freight + Insurance + Destination costs + Duty + VAT/local taxes = Landed Cost

Example structure (fill with your quotes)

- Ex-Factory (per pair) = Materials + Labor + Overhead + Waste + Amortized Tooling

Freight (per pair) = (Container or air cost) / pairs shipped

Duty/VAT/Handling = As per broker calculation (by HS code & CIF)

Landed Cost (per pair) = Ex-Factory + Freight + Duty + VAT + Handling

Target Margin = (Retail – Landed) / Retail

Pro tip: calculate CBM per carton and pairs per CBM; optimize carton size to lift shipping efficiency by 5–12%.

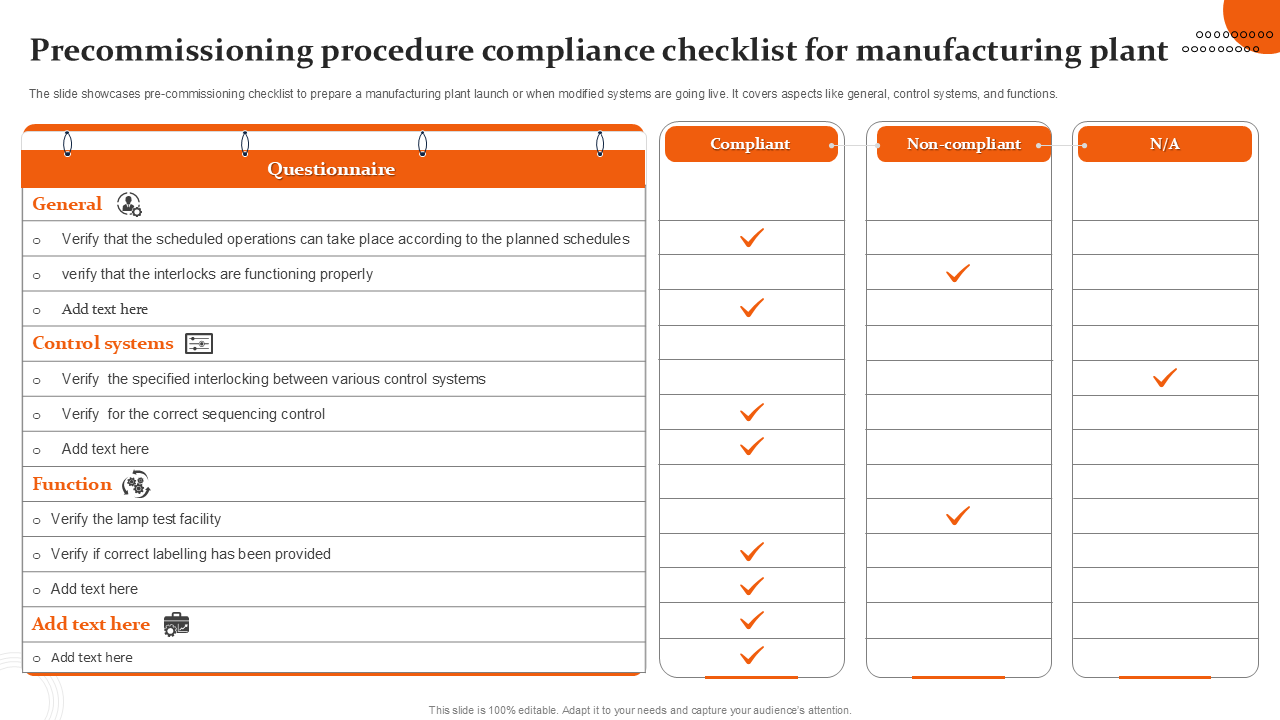

7) Quality Control that Actually Works

Sampling milestones

- Design sample (T0) → aesthetics & fit.

- Pre-production (PPS/T1) → made on line with approved materials; lock golden sample.

- Size set → verify grade across size run.

- TOP (T3) → off-the-line sample of mass goods, used for launch assets.

Inline & final inspections

- Inline checkpoints: upper stitching, bonding (peel test zones), logo placement, sole adhesion.

- AQL sampling (ANSI/ASQ Z1.4): common AQL 2.5 (major) / 4.0 (minor); 0 acceptance for critical (safety/chemical).

- Visual & functional checks: symmetry, pair matching, glue marks, outsole flatness, heel height variance, slip test spot check.

Packaging QA

- Barcode scannability (GS1), carton ECT (e.g., 44 ECT 5-ply), ISTA 1A drop test for DTC/e-comm programs, humidity control (desiccants).

8) Compliance & Sustainability (what buyers ask for in 2025)

Factory systems

- ISO 9001 (quality), ISO 14001 (environment), BSCI/SMETA (social).

- Keep latest audit summaries on file.

Materials chain of custody

- GRS (recycled content): verify the scope certificate and require TCs for each PO.

- GOTS (organic cotton) for textile components.

- OEKO-TEX® STANDARD 100 for contact safety (textile parts).

- FSC for paper boxes, cork sources.

Market compliance

- REACH SVHC monitoring for EU; Prop 65 awareness for US; Arabic/English packaging for GCC markets; ISPM 15 for wood pallets.

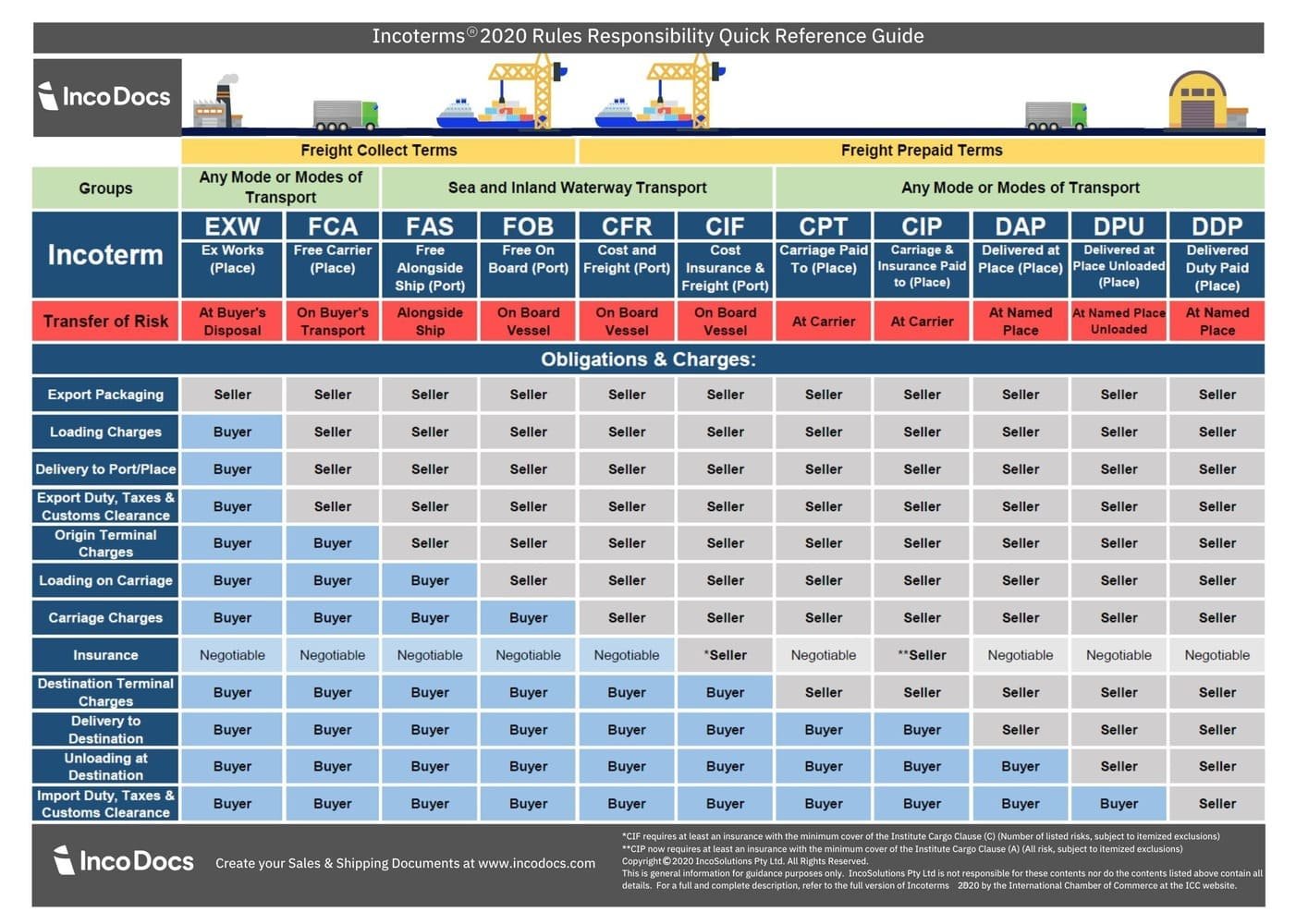

9) Incoterms, Freight & Cartons (smart logistics choices)

Incoterms 2020 (practical picks)

- FOB (you control freight; best visibility).

- CIF (supplier books sea freight; you handle local clearance).

- DDP (only with trusted partners; higher price, less control).

Container math

- Master carton outer: length × width × height (cm) → CBM/carton.

- Pairs per carton × cartons → total pairs; compare pairs per CBM across packaging options.

- Keep gross weight < 15 kg for retail handling where required.

Moisture & heat

- EVA/PU are heat-sensitive; avoid direct container roof loading; use kraft slip sheets, desiccant packs, vented containers in summer lanes.

10) Project Timeline (from brief to delivery)

A realistic first-order plan (weeks):

- Week 0–1: RFQ + tech pack handover

- Week 1–2: T0 sample; feedback loop

- Week 2–3: PPS/T1; lab booking for key tests

- Week 4–9: Bulk production (30–45 days)

- Week 6–9: Inline inspections

- Week 9–10: Final inspection + TOP samples + ship

- Week 10–14: Ocean transit (route dependent) or Week 10–11: Air delivery

Build a Gantt with critical path: material lead times, lab slots, booking ETD, and destination sell-in dates.

11) Vendor Due Diligence (before you commit)

On-site or virtual audit checklist

- Cutting/sewing/injection line layout & 5S; WIP levels; bottlenecks.

- Capacity proof: lines, shifts, historic monthly output; peak season plan.

- Incoming QC (fabric/foam), adhesive storage, aging test process for bonded parts.

- Traceability for eco claims (GRS/GOTS/FSC docs).

- HR policies & social audit status (BSCI/SMETA).

Red flags

- “Everything is possible” with no data; no PPS before mass; unwilling to share audit summaries; inconsistent sampling lead times.

12) Negotiation Playbook (win-win, not just price)

- Trade flexibility for efficiency: agree to color/material consolidation to unlock lower MOQs.

- Offer rolling forecasts (quarterly) to secure capacity without over-committing.

- Pricing tiers tied to pairs per color/size and carton standardization.

- Ask for performance rebates (e.g., late delivery deductions) only after trust is built.

13) Case Study: A Factory That Ticks the Boxes

Ningbo Cotton Slipper Co., Ltd. (Zhejiang, China)

- Low MOQ: 500 pairs (simple) / 1,000 pairs (complex 3D).

- Speed: 3–5 days design, 7–10 days sampling, 30–45 days bulk.

- Capacity & Stock: 600,000 pairs/month; 50,000–60,000 pairs in stock for 24-hour shipment on bestsellers.

- Certifications: ISO 9001, ISO 14001, BSCI, GRS.

- Eco options: rEVA (≥20%), rPET 100D/150D (GRS), bamboo (200–250 g/m²), GOTS organic cotton, cork, FSC packaging.

- Markets: Australia, UAE, Japan, Korea, Canada.

A pragmatic first choice for buyers who need certified eco materials + low MOQ + fast turnaround.

14) Buyer Checklists (copy/paste to your RFQ)

A. Data to send with your RFQ

- Target retail & price band, MOQ per color, annual volume scenario.

- Size run, fit notes (wide/narrow), target markets.

- Material preferences (rEVA/rPET/organic cotton/bamboo), colorways (Pantone).

- Branding methods and packaging spec (FSC/no-plastic?).

- Test plan & AQL targets; Incoterm (FOB/CIF/DDP); target ETD.

B. What to ask the factory to return

- Detailed BOM & cost split, sampling lead time, bulk lead time.

- Photos & measurements of samples vs. spec (tolerance sheet).

- Certifications (ISO/BSCI + GRS/GOTS/FSC scope) and recent audit date.

- Carton spec + pairs/carton + CBM; estimated pairs per CBM.

15) FAQs (Advanced)

Q1: EVA slides vs. textile indoor slippers—failure modes?

- EVA: strap pull-out, yellowing, compression set.

- Textile: seam slippage, outsole peel, pile shedding. Mitigation: define peel strength, seam strength, anti-yellowing, and washing care where applicable.

Q2: How to stop outsole detachment complaints?

Specify adhesive type, bonding temperature/time, roughening pattern, and peel strength acceptance (e.g., ≥2.5 N/mm). Add periodic peel tests during inline inspection.

Q3: My white slippers turn yellow in the warehouse.

UV/heat triggers EVA yellowing. Use anti-yellowing masterbatch, avoid roof-top stow, add UV-blocking bag, ship in ventilated containers in summer.

Q4: Do I really need GRS TCs for recycled claims?

Yes. A scope certificate proves the factory is certified; a TC ties your PO to certified input. Without TCs, you cannot legally market recycled claims in many retailer programs.

Q5: What AQL should I choose?

Typical footwear: Critical 0, Major 2.5, Minor 4.0. Premium programs can go 1.0/2.5. Don’t set it so low that production slows to a crawl on value lines.

Q6: How much tooling costs for EVA molds?

Ranges widely by size run & cavity count; treat it as capex amortized per pair. Ask for multi-size mold proposals to reduce per-size cost; confirm steel grade and lead time.

Q7: Can I hit 500-pair MOQ with 3 colors?

Often yes if materials are shared. Example: 2× base colors + 1× accent with same lining/sole. Keep color changes to strap/upper only.

Q8: What’s the fastest route to market for a new brand?

Start with in-stock bestsellers (24-hour ship) + 1–2 custom styles. Use air for launch, switch to sea for replenishment once sell-through is proven.

Conclusion & Next Steps

A reliable slipper manufacturer is not just “the lowest price”. It’s the partner who can meet your spec, pass your tests, hit your dates, document your claims, and scale with you.

If you want a factory that already operates to these standards, consider Ningbo Cotton Slipper Co., Ltd.—low MOQ, fast turnaround, certified eco materials, and global export experience.

→ Request a 48-hour sample plan and a detailed BOM-based quote for your next collection.