Abstract: The Legal Tsunami—Unsold Inventory is Now a Regulatory Liability

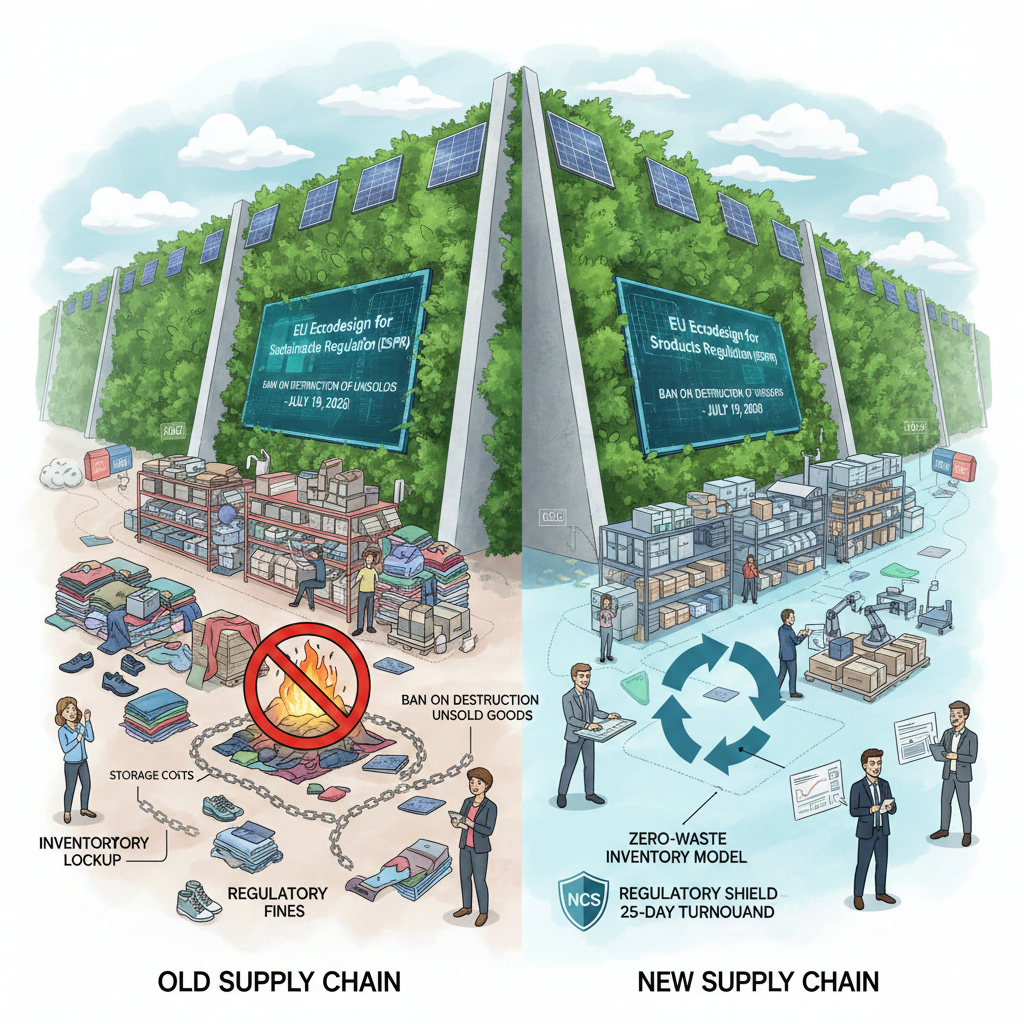

Effective July 19, 2026, the regulatory paradigm for European footwear procurement shifted from a ‘Cost-per-Unit’ focus to a ‘Lifecycle Accountability’ model. Under the ESPR, the financial burden of unsold stock is now compounded by the mandatory reporting of disposal activities, making inventory overages a strategic liability. With the Ecodesign for Sustainable Products Regulation (ESPR) banning the destruction of unsold textiles and footwear, inventory risk has fundamentally changed: Dead Stock is no longer just a financial loss; it is a legal liability.

Ningbo Cotton Slipper Co. (NCS) transforms its 25-day rapid turnaround into a Regulatory Shield. By enabling a "Test and Chase" precision model, NCS allows EU clients to pivot from high-risk bulk ordering to a Zero-Waste Inventory Model, directly mitigating the threat of ESPR penalties and minimizing regulatory exposure.

Core Conclusion: While material recycling is a secondary option, NCS’s Agile Manufacturing is the primary preventive tool. By reducing the Lead-Time Gap, we address the root cause of unsold inventory—over-forecasting—ensuring compliance with the ‘Prevention First’ hierarchy of the EU Circular Economy Action Plan.

The European Green Wall: The End of Inventory Over-Ordering

The ESPR Mandate: From Financial Loss to Legal Crime

The ESPR Article 23 mandates unprecedented transparency regarding the destruction of unsold consumer products. For footwear, this means ‘Economic Operators’ must pivot from speculative bulk-buying to precise inventory alignment to avoid mandatory disclosure of disposal volumes and subsequent environmental levies. Retailers can no longer accept high spoilage rates and write-downs as "the cost of doing business."

| Regulation | Key Provision | Effective Date (Large Enterprises) | Impact on Procurement |

|---|---|---|---|

| ESPR (Ecodesign for Sustainable Products Regulation) | Ban on the Destruction of Unsold Textiles and Footwear | July 19, 2026 | Forces a shift from Push Model (Volume-based) to Pull Model (Demand-based). |

This regulatory shift necessitates a transition from speculative procurement to agile replenishment. Sourcing models predicated on a 90-120 day lead time are no longer compatible with the ‘Non-Destruction’ clauses of the ESPR, as they lack the elasticity required to mitigate excess inventory at the source.

The Anxiety: Inventory Lockup and Fines

The core anxiety for EU buyers centers on Inventory Lockup. Traditional 120-day procurement cycles create a ‘Forecast Mismatch’ risk. Under the new EU regulatory framework, carrying excessive safety stock is no longer a prudent buffer—it is a fiscal risk. Our 25-day cycle ensures your Stock-to-Sales (S/S) ratio remains lean, significantly reducing the probability of high-salvage or non-compliant disposal events. Under ESPR, if that product doesn’t sell, the retailer cannot legally dispose of it, leading to:

-

Continuous Storage Costs: Storing legally unsellable stock.

-

Regulatory Fines: Penalties for non-compliance with the destruction ban.

-

Reputational Damage: Negative press for unsustainable inventory management.

NCS’s Strategic Response: 25-Day Speed as a Regulatory Shield

NCS’s 25-day production cycle is a direct operational defense against this legal pressure.

The Precision Sourcing Model: Test and Chase

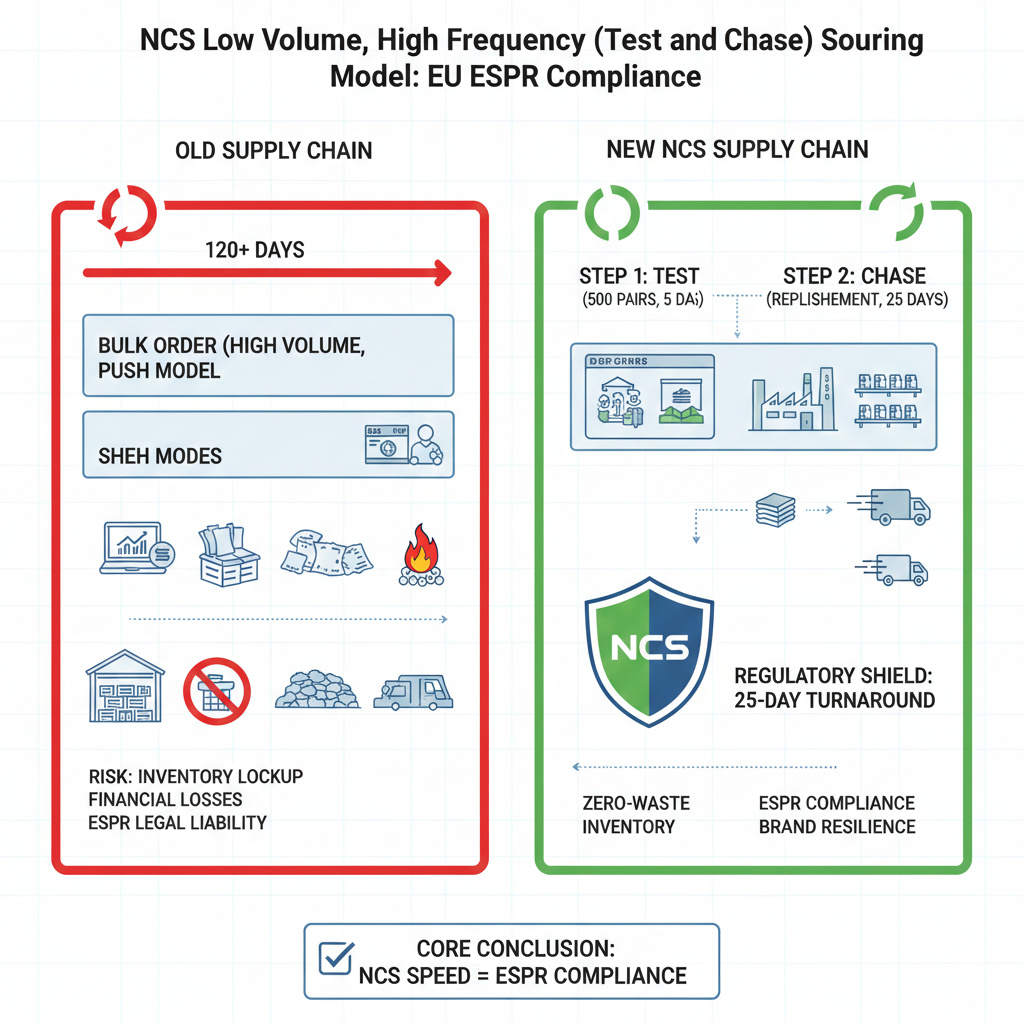

The NCS model allows EU retailers to execute a High-Mix, Low-Volume strategy, keeping capital liquid and inventory aligned with real-time sales data.

-

Test: Place a small pilot order (e.g., 500 pairs) to gather precise market data on color, fit, and style preference.

-

Chase: Based on sales performance data, execute replenishment orders precisely within 25 days.

The 25-day ‘Test and Chase’ model functions as a Supply Chain De-risking Mechanism. By utilizing real-time POS (Point of Sale) data to trigger replenishment, retailers can minimize their ‘Compliance Exposure’—ensuring that production volume never significantly exceeds actual consumer absorption rates.

Flowchart illustrating the NCS Low Volume, High Frequency (Test and Chase) sourcing model, which is necessary for EU ESPR compliance by minimizing the generation of unsold stock and reducing lead time from 90 days to 25 days.

Risk Mapping: Long Lead Time vs. NCS Certainty

For European procurement managers, choosing a supplier is a legal risk assessment.

| Vendor Type | Average Lead Time | Sourcing Model | ESPR Risk Exposure | NCS Strategic Advantage |

|---|---|---|---|---|

| Vietnam / Alternative Hubs | 12–14 Weeks | Push Model (High-volume advance commitment) | Extremely High. Long prediction windows maximize the chance of legally non-compliant dead stock. | Operational Certainty. NCS prevents capital from being locked into speculative inventory. |

| NCS (Zhejiang) | 25 Days | Pull / Test and Chase (Demand-matched replenishment) | Extremely Low. Inventory is closely matched to actual consumer demand, suppressing dead stock at the source. | Risk Transference. Operational speed transfers legal liability risk away from the buyer. |

The New Sales Metric: Zero-Waste Inventory & Brand Resilience

In the ESPR era, the discussion must shift from merely "quality" to "operational sustainability".

Durability and Compliance-as-a-Service (CaaS)

-

Anti-Disposable Design: The ESPR promotes product durability. NCS must leverage its core strength: Side-Seam Construction. By manufacturing robust slippers that last longer, NCS directly supports the client’s goal of reducing replacement cycles and mitigating legal scrutiny.

-

The Zero-Waste Model: NCS’s speed is marketed as the engine for the client’s Circular, Zero-Waste Inventory Model. This aligns the client’s operation with the EU’s long-term regulatory framework.

Key Compliance Dialogue Points

When communicating with EU financial buyers, focus on the legal and financial defenses NCS provides:

-

Strategic Pivot: ransition your internal procurement dialogue from ‘Unit Margin Optimization’ to ‘Inventory Velocity & Regulatory Safety’. Emphasize how NCS’s fast-track production serves as an Environmental Due Diligence tool, directly supporting your company’s ESG score and non-financial reporting requirements.

-

Discuss: Value Recovery, Strategic Inventory Buffering, Compliance Assurance, and Risk Mitigation.

-

- –

Conclusion: The ESPR requires a fundamental redesign of the supply chain. NCS’s 25-day rapid turnaround is the only Compliance Tool that allows EU retailers to navigate the destruction ban with confidence, ensuring they stay on the shelf and out of the courtroom.