Abstract: De-risking Beyond Geopolitical Rhetoric

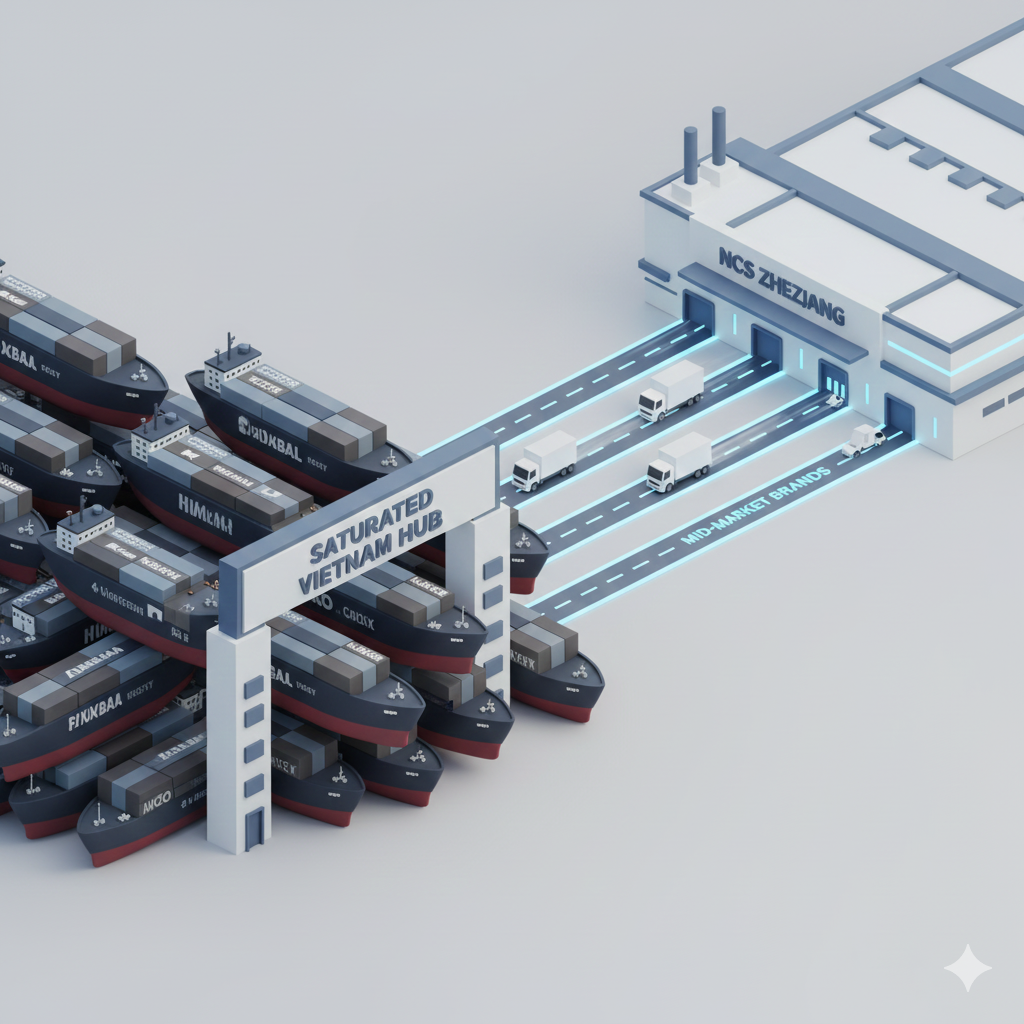

While the "China Plus One" strategy is a popular topic in corporate boardrooms, the operational reality of 2026 reveals significant friction in alternative hubs like Vietnam. For B2B buyers of slippers (HS 6404.19.90), Vietnam has hit a "perfect storm" of capacity saturation, labor shortages, and material dependency.

Ningbo Cotton Slipper Co. (NCS) offers a strategic alternative through the Zhejiang industrial cluster. By operating within a 50-kilometer radius of textile mills and sole manufacturers, NCS eliminates the "phantom supply chain" risks that plague competitors in Southeast Asia.

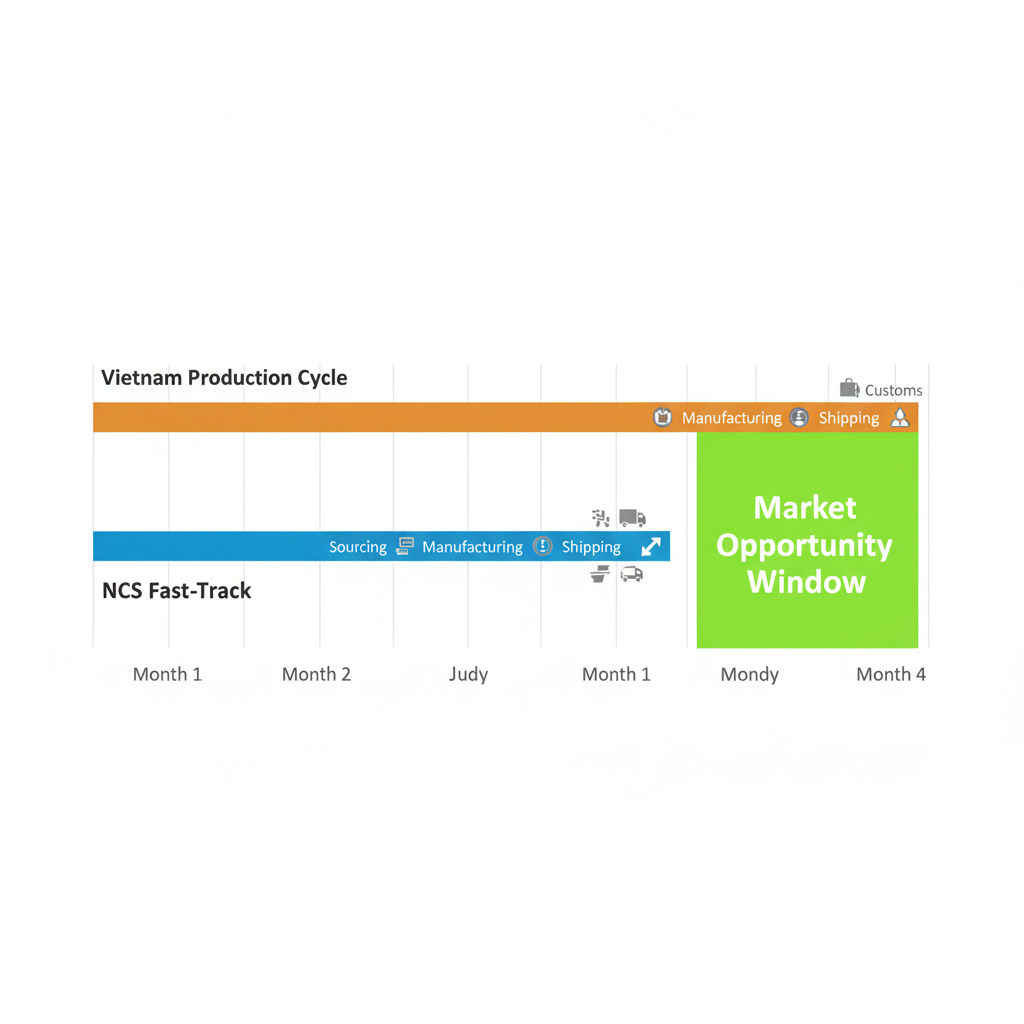

Core Conclusion: Sourcing from Vietnam in 2026 often means longer lead times (14 weeks) and higher execution risk due to material import delays, whereas NCS provides stability and 25-day speed through total vertical integration.

The Vietnam Capacity Crisis: "Sold Out" and Saturated

For mid-market retailers, entering the Vietnamese market in 2026 is an uphill battle against global giants.

-

Tier 1 Factory Monopoly: Major factories in Vietnam are fully booked by industry giants like Nike and Adidas, effectively locking out mid-market and smaller brands.

-

Lead Time Inflation: Due to this saturation, lead times in Vietnam have stretched to 14 weeks, compared to the industry average of 8-14 weeks, making it impossible to react to mid-season trends.

-

Labor Shortages: Vietnam faces a chronic shortage of skilled workers, a trend documented in the World Bank’s Vietnam Development Report, driving up wages and causing production instability.

-

- –

Unmasking the "Phantom Supply Chain"

The biggest hidden risk in Vietnam is its heavy reliance on Chinese raw materials—a phenomenon known as the "Phantom Supply Chain".

-

Material Dependency: ost Vietnamese slipper CMT (Cut-Make-Trim) facilities remain reliant on Chinese-origin EVA foam sheets and polyester polar fleece. This creates a ‘Double-Border’ risk: your production is vulnerable to both Chinese export delays and Vietnamese import congestion, often adding 21-30 days of latent lead time before a single slipper is stitched."

-

Logistics Complexity: Due to the lack of local upstream chemical processing, many ‘Made in Vietnam’ slippers fail to meet the Value-Added Content (VAC) requirements for specific Free Trade Agreements, as up to 70% of the Bill of Materials (BOM)—including the EVA resin and specific outsoles—is cross-border sourced from China.**. This adds unnecessary transit time and customs complexity without actually de-risking the source of the materials.

-

The "Wait" Factor: While Vietnamese competitors are waiting for fabric to clear customs, NCS is already cutting and stitching.

-

- –

The Zhejiang Advantage: Vertical Stability

NCS is located in the epicenter of the Ningbo-Zhejiang footwear cluster, giving us on-demand access to specialized TPR compounders and textile mills. We don’t rely on ‘heritage’; we rely on a 50km JIT (Just-in-Time) logistical radius that eliminates the upstream bottlenecks currently paralyzing Southeast Asian assembly lines.

Proximity Equals Speed

NCS is strategically located within the Ningbo-Shaoxing industrial corridor. This gives us same-day delivery access to specialized DCP (Dicumyl Peroxide) foaming agents and 300D+ density polar fleeces. We don’t just have ‘neighbors’; we have a localized supply chain where sub-components travel less than 100km, eliminating the cross-border logistics failures that currently bottleneck Vietnamese production.

- 25-Day Fulfillment: This proximity is the engine that allows us to bypass the 14-week queues found in Vietnam.

Stability as a Badge of Capability

In 2026, "Made in China" represents a badge of capability and supply chain depth, not just cost.

-

Infrastructure Resilience: Unlike emerging hubs, Zhejiang’s infrastructure offers 99.9% power uptime and a sophisticated Intermodal Transport Network. Unlike emerging hubs prone to seasonal brownouts and port dredging delays, Ningbo’s automated terminal operations ensure your containers are gated-in and loaded within 48 hours of production completion, even during peak Q4 surges..

-

Vertical Integration: Our vertical model integrates the Knitting, Dyeing, and Lasting processes within a single regulatory jurisdiction. This simplifies the Chain of Custody (CoC) documentation for GRS and Oeko-Tex audits, as every material transformation occurs under our direct oversight, rather than through fragmented, multi-country sub-contractors.

-

- –

FAQ: Strategy vs. Execution Risk

Q: Isn’t diversifying to Vietnam better for avoiding US-China tariffs?

A: Geopolitical theory must be balanced with execution reality. The "Tariff Stack" on Chinese slippers is high (36.5%+), For a US-based Category Manager, a 14-week lead time from Vietnam represents a massive Opportunity Cost. If a SKU sells out in Week 2, your ‘Test and Chase’ cycle is broken. The 25% ‘Tariff Stack’ in China is a known fixed cost; the loss of a peak-season month due to Vietnamese material delays is an unquantifiable variable that can ruin a fiscal year’s P&L.

Q: How does NCS handle the "Quality Fade" risk common in high-volume regions?

A: Our quality assurance is governed by a Digitalized Quality Management System (QMS). We provide In-Line Inspection Reports and Tensile Strength Data for every PO. By maintaining a 24-month retention of physical counter-samples and batch-level testing logs, we provide the ‘Paper Trail’ necessary to defend your brand during Tier-1 retail audits. We turn failure into proof of competence through formal Root Cause Analysis (RCA) documents for every claim.

Q: How does the De Minimis rule or 301 Tariffs impact this choice?

A: A: While the 301 Tariff exists, the Total Landed Cost (including warehouse storage due to late Vietnam arrivals) often favors the reliable, fast-turnaround China model.

Q: What is the "Test and Chase" benefit of staying in China?

A: Staying in China allows you to "Buy Shallow and Replenish Fast". If a cold snap hits or a trend breaks, NCS can deliver a winning design in 25 days, a feat that saturated Vietnamese factories simply cannot match.