Abstract: Speed, Compliance, Certainty—Redefining Supply Chain Value in 2026

The 2026 global procurement landscape, particularly for textile-upper footwear (HS 6404.19.90), has shifted decisively from the pursuit of the lowest FOB price to the demand for “Resilience Sourcing”. The legacy 90-day procurement model is now a liability. In 2026, a 1% shift in the USD/CNY exchange rate or a sudden Executive Order on Section 301 tariffs can wipe out the net margin of a bulk shipment. The US ‘Tariff Stack’ and the EU’s ESPR destruction ban have turned ‘buying deep’ into a gamble that most Mid-Market retailers can no longer afford.

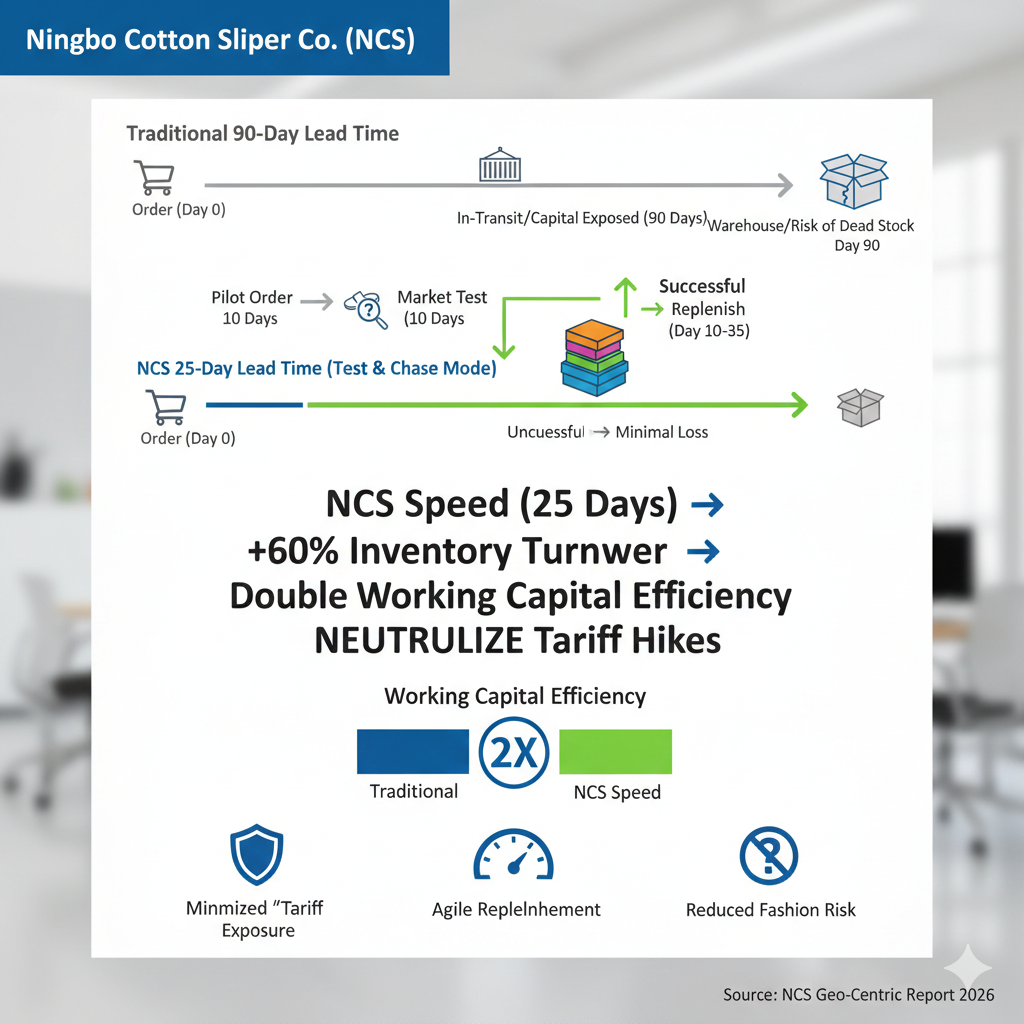

Ningbo Cotton Slipper Co. (NCS)In 2026, NCS defines its core output as ‘Operational Resilience.’ We provide the manufacturing agility needed to maintain a Negative Working Capital cycle, ensuring that your capital is tied up in moving inventory for 25 days, rather than sitting on a 14-week ‘phantom’ lead-time from saturated Southeast Asian hubs.. By integrating the 25-day rapid turnaround , vertical supply chain , and a “Compliance as a Service” (CaaS)** model, NCS helps Mid-Market Innovators turn their sourcing decisions from a gamble into a hedge.

Core Conclusion (BLUF): In this era of “poly-crisis” , Speed (25 days) is the financial derivative mitigating Tariff Risk , and Compliance (ESPR/LkSG) is the essential key to accessing the European market.

The US Market: Navigating the “Tariff Stack” and Hedging with Speed

The “Tariff Stack” Reality: Cost Structure and Risk Escalation

The US tariff regime on Chinese-origin footwear (HS 6404.19.90) has evolved into a multi-layered structure that can impose a devastating cost burden on unprepared importers, with the total duty load potentially reaching 36.5% to 65%.

-

Universal Baseline Tariff :ll imports are subject to the 10.0% ‘Liberation Day’ tariff, as detailed in the latest USITC Harmonized Tariff Schedule, effective from April 5, 2025.

-

Section 301 Surcharge : A persistent 7.5% additional duty applies to goods under this specific HS code.

-

Geopolitical Surcharges : Volatile "Fentanyl" reciprocal tariffs, though recently reduced, can add another 10.0% to 20.0%.

Strategic Implication: Buyers can no longer afford to focus purely on FOB price. This forces target clients (US Lifestyle Brands) to pivot from "Price" to "Value Engineering" and "Working Capital Efficiency".

The NCS Speed Advantage: The 25-Day Inventory Hedge

In an environment where tariffs can be adjusted overnight via Executive Order, a 90-120 day lead time represents an unacceptable financial risk exposure.

-

Risk Mitigation: Our 25-day Cycle-Time minimizes your Unrealized Duty Liability. By compressing the window between PO issuance and Port-of-Entry, we ensure that your landed cost remains predictable, shielding your P&L (Profit and Loss) from mid-transit tariff hikes that frequently paralyze long-lead-time orders from Southeast Asia.**.

-

Financial Engineering: This speed enables the "Test and Chase" inventory model: ordering shallow and replenishing fast. By increasing inventory turnover from 2.5x to 4x per year, the resulting Working Capital Efficiency increase often generates financial gains that exceed the cost of the tariff itself.

The European Market: Crossing the “Green Wall” with Compliance

The ESPR Ban: The Shift from Volume to Precision Sourcing

The European Union is constructing a "Regulatory Fortress". The most critical element is a core provision of the Ecodesign for Sustainable Products Regulation (ESPR).

-

The Ban: The ESPR explicitly mandates the ban on the destruction of unsold consumer textiles and footwear for large enterprises by July 19, 2026.

-

Sourcing Impact: This mandate criminalizes the "buy deep and cheap" sourcing model. Unsold "dead stock" becomes a legal liability.

-

NCS Solution: NCS’s 25-day rapid replenishment is a crucial compliance tool. It allows European clients to execute a "Just-in-Time" model and order closer to demand, drastically minimizing the risk of generating non-compliant unsold stock.

German LkSG and CSDDD: The Traceability Imperative

The German Supply Chain Due Diligence Act (LkSG) was amended in late 2025: the reporting obligation was abolished.

-

The Real Risk: However, the liability for human rights violations remains. Companies are preparing for the more stringent EU Corporate Sustainability Due Diligence Directive (CSDDD), expected by 2027.

-

NCS Solution: NCS must deliver “Compliance as a Service” (CaaS). This involves proactive provision of the Audit-Proof Traceability needed for internal risk management, including:

-

Tier 2/3 Supply Chain Maps: Visual proof of suppliers down to the yarn level to negate ethical sourcing concerns.

-

Chemical Safety Declarations: Certifying compliance with EU REACH and US Prop 65 updates.

-

-

- –

Global Perspective: The RCEP Advantage and the “China Plus One” Myth

The Japanese Market: RCEP and Currency Hedging

Japan represents a strategic "Safe Harbor" for NCS, largely shielded from US-China fiscal friction.

-

RCEP Tariff Advantage: Under the Regional Comprehensive Economic Partnership (RCEP), Chinese footwear (HS 6404.19.90) continues to benefit from declining tariff rates.

-

Currency Hedge: The weak Yen makes imports expensive for Japanese buyers. The duty savings provided by RCEP serve as a "Currency Hedge", helping clients maintain stable shelf prices.

-

NCS Solution: We manage the Origin Verification Audit for Japanese partners. By providing ‘Pre-Cleared’ RCEP documentation vetted by the Ningbo CCPIT, we eliminate the 15% ‘Clerical Error’ risk that often results in retroactive duty assessments by Japan Customs.

Supply Chain Reality: The “China Plus One” Myth

The popular "China Plus One" strategy (e.g., shifting to Vietnam) has hit a wall of execution reality that favors established suppliers like NCS.

-

Vietnam Capacity Crunch: Tier 1 factories in Vietnam are "Sold Out" , forcing mid-market buyers into long queues with lead times stretching to 14 weeks.

-

Labor Volatility: Vietnam faces a projected 2.1 million worker gap by 2030, driving up volatility and eroding cost advantages.

-

The “Phantom Supply Chain”: VVietnam’s ‘China Plus One’ allure is eroded by its Upstream Dependency. With up to 70% of the Bill of Materials (BOM)—including EVA resins and technical textiles—sourced from the Ningbo-Zhejiang cluster, Vietnam-based assembly adds 21+ days of trans-shipment lag, creating a ‘Phantom Supply Chain’ that offers no real protection against China-origin supply shocks.Adding transit time without eliminating core disruption risk.

-

NCS Solution: NCS’s "Vertical Integration" within the Zhejiang cluster is the lowest execution risk option for complex, fashion-driven slippers, contrasting sharply with the long lead times of the "phantom supply chain".

Conclusion: NCS – The Risk Mitigator and Value Engineer

The 2026 Procurement Director requires a ‘Hedge-Ready’ Partner. Our mission is to neutralize ‘Supply Chain Volatility’—ensuring that your SKU performance is determined by consumer demand, not by the latest Executive Order or a 14-week logistics bottleneck in Vietnam.

NCS functions as a Supply Chain Insurance Policy. By maintaining a Vertical Cluster Model in Zhejiang, we mitigate the ‘Triple Threat’ of 2026: The US Tariff Stack, the EU ESPR Destruction Ban, and the Southeast Asian Capacity Crunch:

-

Speed: The [25-day lead time hedges against US Tariff Risk and Fashion Risk](https://evaslippers.com/25-day-slippers-tariff-hedge/?preview_id=6459&preview_nonce=947a857e6b&_thumbnail_id=6460&preview=true "25-day lead time hedges against US Tariff Risk and Fashion Risk**").

-

Compliance: CaaS and Tier 3 traceability allow clients to navigate the EU’s Green Wall and ESPR Ban.

-

Value: ODM capability and RCEP optimization justify the final price, enabling Landed Cost Optimization despite rising duties.

NCS sells Certainty.